What if your entire supply chain strategy was based on one person’s gut feeling? It happens more often than you think.

Forecasting isn’t about being right—it’s about being prepared. And in today’s volatile markets, relying on a single forecast is like gambling with your supply chain. That’s where consensus forecasting comes in.

This article unpacks how consensus forecasting—a method that merges multiple perspectives into one unified forecast—can help both enterprise demand planners and SMBs navigate uncertainty and plan smarter. Whether you’re managing global inventory or running a scrappy supply chain with tight cash flow, this approach could transform how you respond to demand volatility.

Contents

What is a demand plan?

(And why Widget Inc. can’t afford to get it wrong.)

Let’s start simple.

- Widget Inc. sells widgets.

- Widget Inc. has competitors. If they can’t deliver, customers will go elsewhere.

- They’ve got a solid business but limited cash flow—so they can’t stockpile products just in case someone orders them.

- Their supplier takes weeks to fulfill orders.

So if demand spikes and they didn’t plan for it?

Too bad—sales walk out the door. - What they need is a demand plan:

A data-informed forecast that estimates future customer demand over a defined period, guiding purchasing, production, and supply chain decisions.

In short: plan right, profit. Plan wrong, panic.

What is Consensus Forecasting?

Imagine you’re a football coach before a championship game.:

- Do you stick with the usual playbook—or adjust based on what your assistants, players, and analysts are telling you?

- Instead of betting everything on one strategy, you synthesize multiple inputs—film reviews, player condition, opponent stats, even what the bookmakers are predicting—to build the best possible game plan.

- That’s consensus forecasting in action.

Consensus forecasting is a collaborative approach that merges multiple forecasting methods to create a unified demand forecast. It leverages input from various stakeholders, such as sales, marketing, and supply chain teams. Each group contributes its insights and data, which are then synthesised into a single finalised forecast.

This method combines qualitative and quantitative techniques. For instance, statistical models (Like ARIMA) might provide baseline forecasts based on stable historical patterns and trends, while expert opinions can adjust these figures based on market trends or upcoming promotions.

Similarly, consensus forecasting integrates diverse viewpoints to produce a more accurate forecast of demand. This collaborative effort reduces bias and improves reliability, making it essential for effective supply chain management.

Pros and Cons of Consensus Forecasting

Why it works

- Mitigates risk through information diversity: A single team might overlook a critical signal. By drawing on multiple perspectives—sales, marketing, finance, supply chain—you reduce the chance of blind spots undermining your forecast.

- Captures market shifts faster: Frontline teams often detect changes in customer behavior or competitive moves before they show up in the data. Consensus forecasting pulls these early warnings into the decision-making process, enabling quicker strategic adjustments.

- Improves seasonal and promotional accuracy: Historical sales trends tell part of the story, but campaigns, new launches, and external events can cause major year-to-year deviations. Consensus forecasting layers real-world context over data-driven models to better anticipate peak periods.

- Responds to real-world disruptions: Not all risks are captured in the numbers. Logistics teams spotting weather disruptions, or operations teams anticipating supplier delays, bring critical insights that pure statistical models would miss. Consensus forecasting ensures these are factored in early.

- Builds cross-functional alignment: When teams are involved in shaping the forecast, they’re more invested in executing against it. Consensus forecasting isn’t just a technical exercise—it also drives organizational cohesion around shared expectations.

Why It’s Tricky

- Time-consuming coordination: Getting input from multiple teams takes effort. Without structure, consensus-building can slow decision-making and consume resources better spent on execution.

- Risk of decision drag: If every voice carries equal weight without prioritization, discussions can spiral into endless debates. Clear frameworks are needed to balance inclusion with decisiveness.

- Groupthink and dominant voices: Consensus can unintentionally suppress dissent. If one department or strong personality dominates, critical insights from others might be lost, undermining forecast quality.

- Dilution of accountability: When everyone contributes, ownership can become unclear. Without defined decision rights and forecast owners, consensus can lead to blame-shifting when projections miss.

- Tendency toward “safe” forecasts: In an effort to reconcile different views, teams may converge toward conservative, middle-ground estimates. This can underprepare the business for true volatility—both upside and downside.

Consensus forecasting is powerful, but it’s not automatic—it demands deliberate process design to unlock its potential without falling into common traps.

Consensus Forecasting in Action: Widget Inc.

Returning to Widget Inc.: imagine you’re tasked with steering their supply chain through uncertainty.

Step 1: Start with the numbers.

Historical data generally serves as the foundation. This includes past sales figures, seasonal patterns, and inventory levels. By analysing this data, planners can identify trends and cycles that inform future demand. For instance, if sales typically spike during the holiday season, this pattern will influence the forecast for the upcoming year.

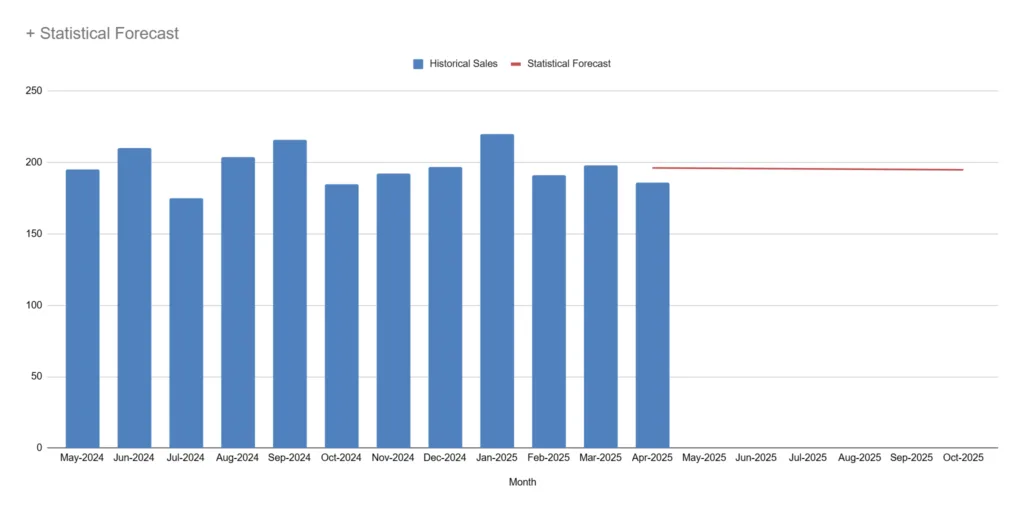

For this example, you create a forecast with a simple linear regression method. It’s a solid baseline—nothing fancy—and there are far too many forecasting methods to cover here.

At first glance, the statistical model seems reasonable—indeed, nine times out of ten, a baseline forecast is a dependable fallback when better information is scarce.

Step 2: Add real-world insights.

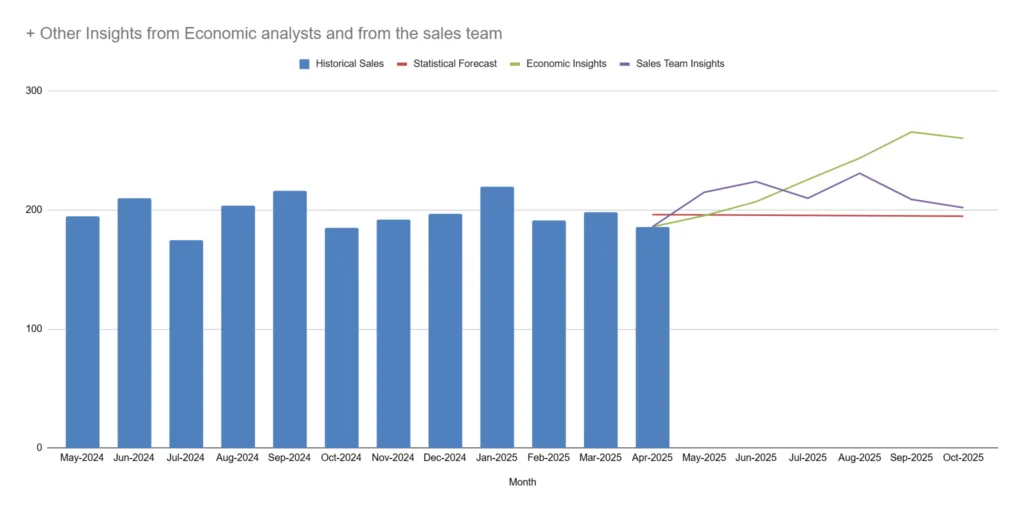

It’s important to consider qualitative insights. Both our economic analysts and our sales team are telling us that demand for Widgets is increasing. Your statistical forecast doesn’t include these insights!

So you gather the inputs from these stakeholders. Each group offers unique perspectives based on their experiences and interactions with customers.

Now as a supply chain leader you’re faced with a decision:

- The ‘data’ doesn’t support this idea that demand is suddenly growing

- The estimates from the analysts and sales might be inflated due to the hype

Step 3: Finalise your forecast

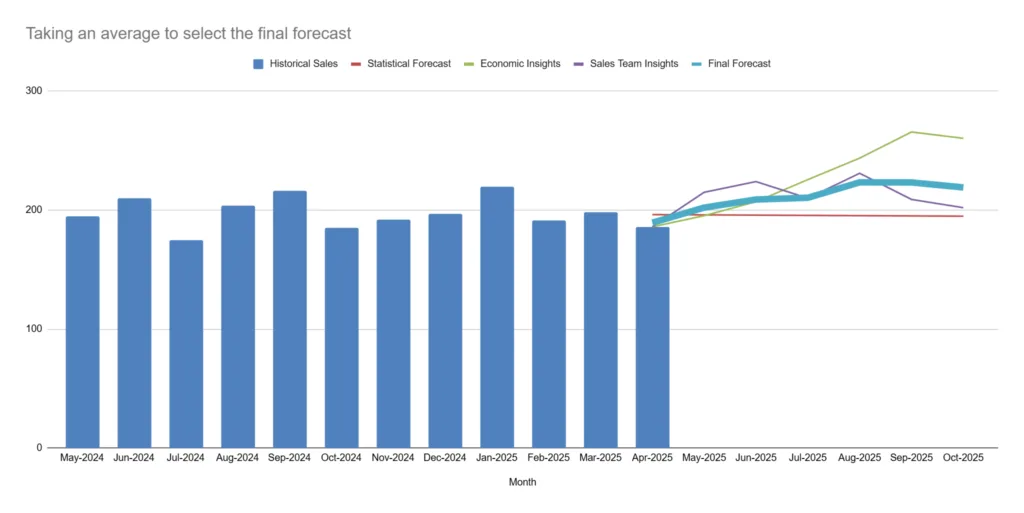

To create a consensus forecast, these elements are synthesised into a single projection. Planners often use collaborative tools or software to facilitate discussions among stakeholders. This ensures that all voices are heard and that the final forecast reflects a comprehensive view of expected demand.

While advanced methods like weighted averages or preferential modeling exist for synthesizing forecasts, in this example, we take a simple average across the three sources.

Why not simply adopt the most optimistic projection? Because for Widget Inc., limited cash flow means over-ordering introduces dangerous inventory risks and financial strain.

In other words, in this example at least, consensus forecasting is attempting to balance taking great market insights against the risk of wasting cash. The dynamics are more nuanced than this and typically there is no one size fits all approach, but this gives a quick introduction into the topic of consensus forecasting

In summary, a consensus forecast for a widget manufacturing company integrates historical data for trend analysis, market trends for external influences, and expert insights for internal perspectives. This holistic approach leads to more accurate and actionable forecasts.

Applications Beyond Demand Planning

Consensus forecasting extends beyond demand planning into various fields, including stock price predictions and weather forecasting.

- In finance, analysts gather insights from multiple sources—market trends, economic indicators, and expert opinions—to create a unified forecast of stock prices. This collective approach reduces individual biases and enhances accuracy.

- Similarly, in weather forecasting, meteorologists combine data from satellites, radar, and historical patterns. They collaborate with different agencies to produce a consensus forecast that informs the public about upcoming weather events. For instance, if one model predicts a storm while another suggests clear skies, the consensus approach helps determine the most likely outcome.

In both cases, the goal is to synthesise diverse information into a reliable prediction. This method not only improves decision-making but also builds confidence among stakeholders who rely on these forecasts for strategic planning.

Conclusions

Ultimately, consensus forecasting presents a robust framework for improving demand planning accuracy. By aggregating diverse forecasts, it mitigates risks and adapts to uncertainties inherent in supply chain management. Embracing this approach not only enhances forecasting precision but also empowers demand planners to make informed decisions that drive organizational success.